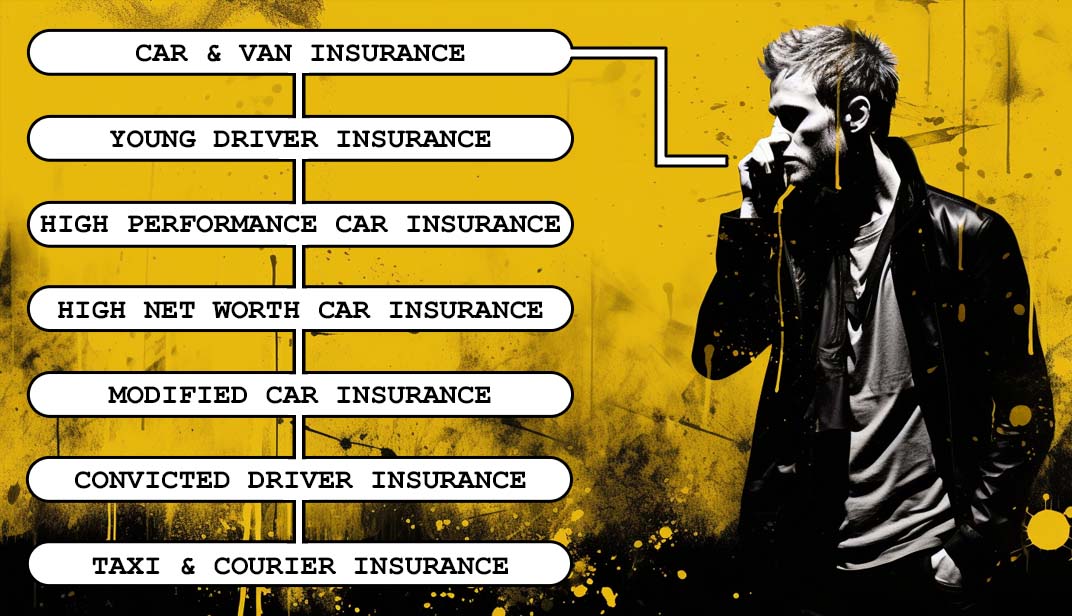

For many of our customers car insurance is their second biggest expense after their rent. Car insurance has been going up for the last few years and so we’ll do our best to help you find the best deal. We specialise in what we call non-standard motor insurance – that’s people with motoring convictions, little or no driving experience, criminal convictions, fast or expensive cars, poor credit history or other factors causing the large insurers to pull out of the market.

There are some tricks to help bring your insurance costs down for example increasing your excess, limiting your mileage, limiting young drivers, paying annually but for some the best thing to do is to get some driving experience on the car and then talk to the professional at Quote Detective.

We look at all aspects of the risk and verify any information via our databases to help build a case to the insurer.

Helping you to find the right insurance helps us to grow our business – we recently insured our 100,000 customer since we started this in 2016.

Issues surrounding non-standard motor insurance

...Before Quote Detective...

In the world of insurance, ‘non-standard’ is a term that often raises eyebrows. So, what exactly does it mean? For many mainstream insurance giants, it translates to a swift ‘no’ issued by an algorithm, leaving countless individuals stranded without coverage. At Quote Detective, we see non-standard as an opportunity to make a real difference. Instead of relying solely on computer-generated decisions, we’ve assembled a team of dedicated detectives who dive deep into the unique risks our customers present. This approach allows us to craft tailored insurance solutions that may include factors like the age of the driver, recent relocations with no credit history, unusual occupations, or even driving convictions. We’re proud to have insured a diverse clientele, from Premier League footballers to Formula 1 drivers, pop stars, and everyday individuals with ordinary jobs.

While non-standard insurance might involve a few more questions, we believe in the importance of getting the details right – it’s the foundation of insurance that truly serves the people it protects.