We insure a lot of vans! From courier drivers to business owners carrying their own goods to surfers taking their boards to the seaside! The number of vans on our roads has multiplied since the pandemic with home delivery now such a large business & they all need insurance.

Whilst there are many similarities between car and van insurance, you’ll need our experts to talk you through the differences; for example some of our partners accept car NCD on vans whereas others don’t, some give discounts for vans with signage, others want to understand how many ‘drops’ you undertake if you are a courier. This is where the experts at QD really earn their money.

We can on occasion ask a lot of questions but it’s so important to get it right – are tools left in the vehicle overnight? Is the business owned by a limited company – these are questions that the large directs don’t get to the bottom of but are crucial to finding you the right policy.

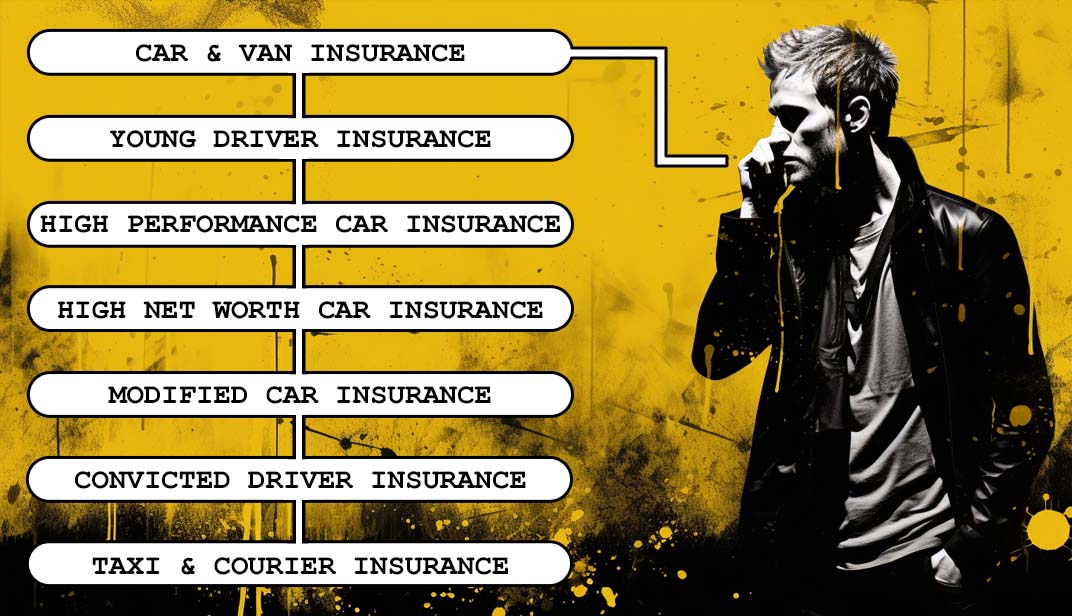

Issues surrounding non-standard motor insurance

...Before Quote Detective...

In the world of insurance, ‘non-standard’ is a term that often raises eyebrows. So, what exactly does it mean? For many mainstream insurance giants, it translates to a swift ‘no’ issued by an algorithm, leaving countless individuals stranded without coverage. At Quote Detective, we see non-standard as an opportunity to make a real difference. Instead of relying solely on computer-generated decisions, we’ve assembled a team of dedicated detectives who dive deep into the unique risks our customers present. This approach allows us to craft tailored insurance solutions that may include factors like the age of the driver, recent relocations with no credit history, unusual occupations, or even driving convictions. We’re proud to have insured a diverse clientele, from Premier League footballers to Formula 1 drivers, pop stars, and everyday individuals with ordinary jobs.

While non-standard insurance might involve a few more questions, we believe in the importance of getting the details right – it’s the foundation of insurance that truly serves the people it protects.