Back in the 90’s car mods were all the rage with magazines such as Maxpower and Evo coming up with weekly tips on how to best modify your car. This has died down a little but we still know how to insure modified cars and your best bet is to speak with one of the Quote Detective team.

Tinting, lowering the suspension, engine modifications – none of these pose too big a challenge although they are likely to push your premium up a little.

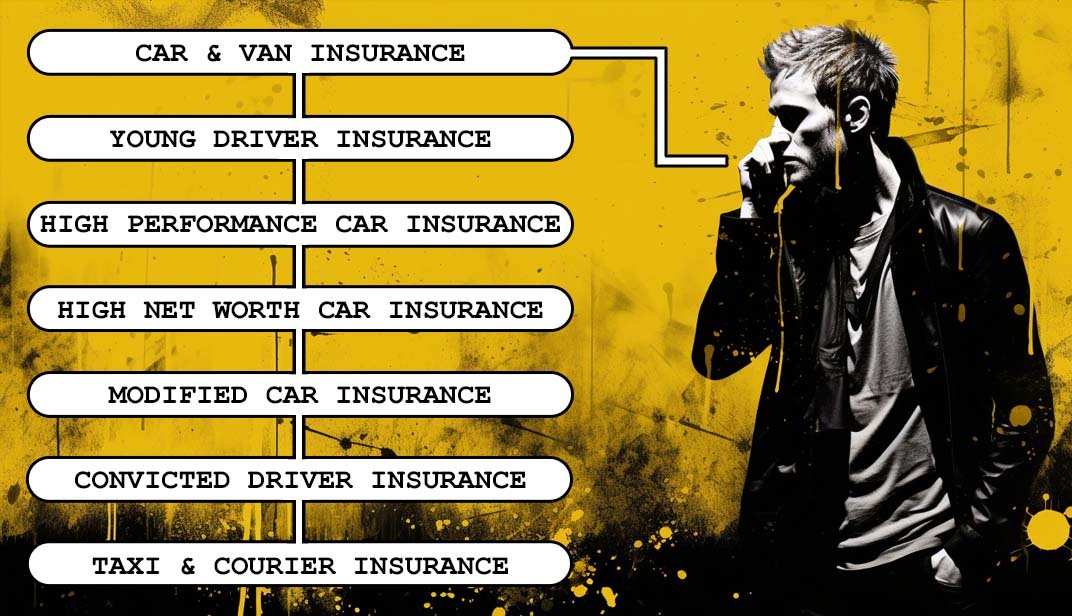

It’s a challenge to get a price out of a comparison site if you enter several mods so we’d suggest you pick the phone up and talk to the team of detectives trained for this sort of challenge.

People who love mods typically love their cars and will want to insure they have the right insurance.

Issues surrounding non-standard motor insurance

...Before Quote Detective...

In the world of insurance, ‘non-standard’ is a term that often raises eyebrows. So, what exactly does it mean? For many mainstream insurance giants, it translates to a swift ‘no’ issued by an algorithm, leaving countless individuals stranded without coverage. At Quote Detective, we see non-standard as an opportunity to make a real difference. Instead of relying solely on computer-generated decisions, we’ve assembled a team of dedicated detectives who dive deep into the unique risks our customers present. This approach allows us to craft tailored insurance solutions that may include factors like the age of the driver, recent relocations with no credit history, unusual occupations, or even driving convictions. We’re proud to have insured a diverse clientele, from Premier League footballers to Formula 1 drivers, pop stars, and everyday individuals with ordinary jobs.

While non-standard insurance might involve a few more questions, we believe in the importance of getting the details right – it’s the foundation of insurance that truly serves the people it protects.